THE GET RICH MONEY GUIDE

Cheap cost. Expensive results. BUY NOW.

Introducing the new & revolutionary... Better for you. Better for everyone. Immaculate results.

What's New In The Get Rich Now Guide?

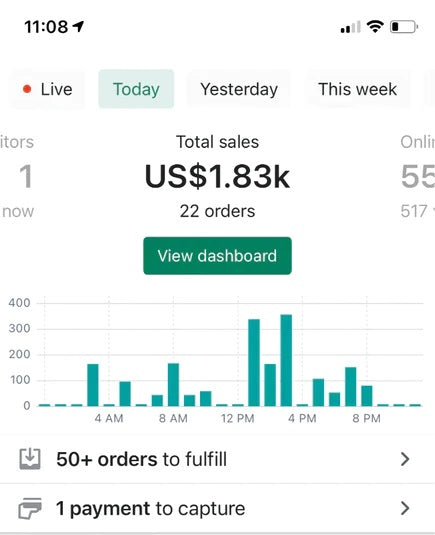

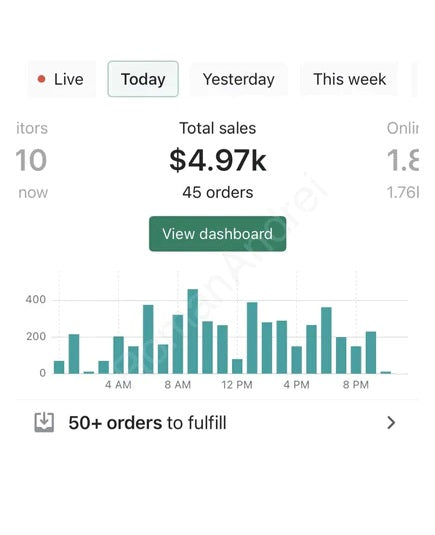

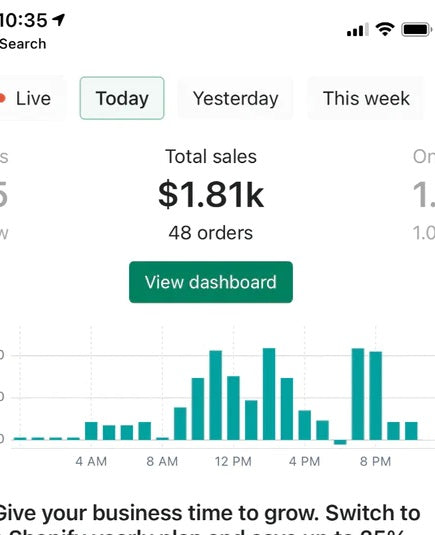

AMAZING RESULTS

As long as you are willing to put in those hours, you will get out the results. Only within a year, you can go from Racks To Riches.

NO MORE HOLDING BACK

You can develop a positive mindset and attitude towards money, wealth, and success. You can overcome limiting beliefs and fears that may hold you back from making more money

FAQ's

What's included?

The Get Rich Guide Includes:

- 20 Pages of High Quality Content

- Actionable Steps To Make Money NOW

- Instant Lifetime Access

Can I Start With $0?

Absolutely! Even though it would help if you started with money, ALL of our methods can be started without any money.

How long does it take to receive?

Once you purchase the PDF, we will email you the download link within minutes.

The Best Money-Making Guide

Regular price

$9.99 USD

Regular price

$19.99 USD

Sale price

$9.99 USD

Unit price

per

Share